|

|

| themanager.org | Search |

Fit for Growth

By Hanns Guenther Bollig

- Results of a European Benchmark on Improvement Programme Effectiveness -

During the boom time of process cost reduction programmes, Automotive Advisors & Associates carried out a European Benchmark Project about “Best Practice” in Improvement Programme Management in the automotive industry. The results are stunning:

· BPR and most of the text book approaches appear not to have delivered the hard results. Yet, the combination of two distinctive improvement programmes have turned out to be the best.

· Whilst management of change will have to become a routine activity, strategy issues are back on top of the board room agenda.

· The coming years will show that only the combination of three core skills can deliver the required results:

· good change and business integration management

· aggressive cost reduction programmes

· effective strategy and customer targeting

· Whilst globalization is on top of the agenda, effective cost management has to be used to make capital available for expansion

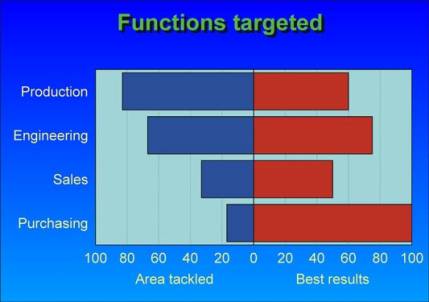

· The focus of actions was on the combination of production and engineering. Only few tackled production alone

· The sales and purchasing functions appeared to have lacked attention. However, purchasing was most often quoted as the function which achieved best success

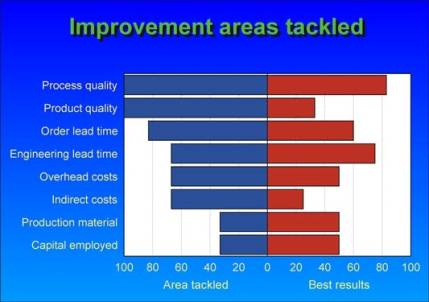

· Most companies have tackled a large number of improvement areas simultaneously (average 5 areas)

· Prime focus was process quality, product quality and order lead time. Those were also the areas where best success was achieved (exception: product quality)

· “Hard” cost reduction areas ranked only second, with little attention spent on production material and capital cost reduction. Few companies are addressing the purchasing potential.

· The improvements achieved appear to vary widely: less successful companies reported 5% to 10% annual improvements, others have achieved breakthrough success of more than 30%

· Process time and personnel cost reduction were most successfully targeted. Average savings of 15% were achieved.

· Material costs and product costs were equally reduced by average 12% per year. Yet, product cost reduction is the crucial measure. Success ranged widely between 5% and 20%.

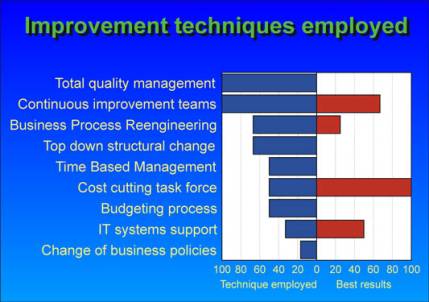

· The average company used 6 techniques during the course of their improvement programmes. Amongst those, cost cutting task forces and continuous improvement teams proved to be the most successful combination (15% to 30% improvements). BPR was less successful, TQM a flop.

· Improvement techniques were employed in typical clusters and produced typical results. There was little difference between various companies using the same approaches.

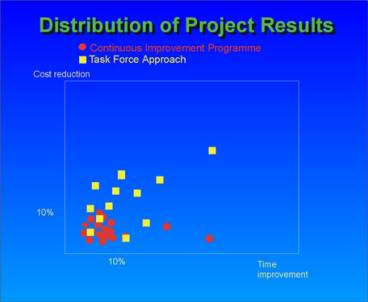

This graph shows the distribution of project results achieved (sample).

· Cost task forces generate 2 to 3 times the cost savings as compared to Continuous Improvement Programmes, however, the results vary widely

· Continuous Improvement Programmes appear to generate guaranteed 5% to 10% productivity improvements, but no break through in cost savings (exception: process lead time improvements).

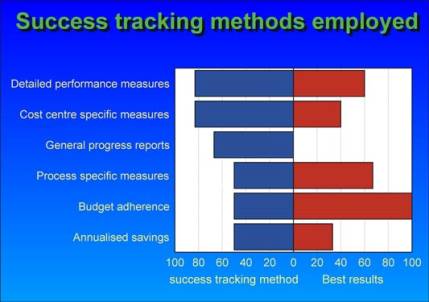

· Success tracking methods are established to motivate the organization to achieve better results faster.

· Detailed performance measures and cost centre specific targets were the most frequently used success tracking methods.

· General progress reports and annualized savings measures proved not to be as successful.

· Best results were reported with strict budget adherence and process related performance measures.

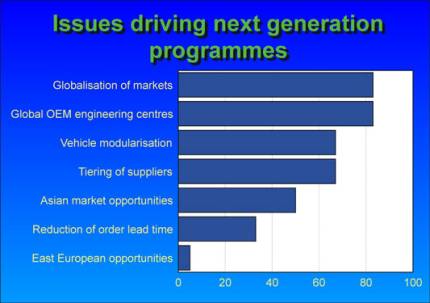

· Globalization of markets and supplies and the global concentration of OEM engineering centres are the main issues now driving supplier programmes.

· Vehicle modularisation and the resulting tier structure of suppliers are the most important issues calling for action.

· Asian market opportunities are still dominating whilst East European market penetration are being put on hold.

Lessons learnt

The ability to carry out effective cost reduction programmes are more essential than ever for survival in the automotive industry. Although most of the OEMs set for themselves and for their suppliers annual targets of 3% or 5% overall cost reduction, such targets are too general and will not deliver.

Many suppliers are still lagging behind in exploiting the most promising areas for cost reduction:

· changing their product design to achieve higher functionality at lower costs

· better integration of second tier suppliers to enhance the effects of design based product cost reduction

· more creative sourcing programmes and more effective cost pressure on their suppliers

· stop experimenting with ineffective measures but concentrating on two programmes: Effective cost cutting task forces supported by broad based continuous improvement programmes

· start introducing strict result controls, stop double counting successes and define clear responsibilities for results

· use effective product and sales strategies to increase market share and improve utilization of assets

· build modular products and stop proliferation of parts

· reduce complexity and find the big savings

· focus on the essentials

If you want to know more, please contact us: Automotive Advisors & Associates