|

|

| themanager.org | Search |

Understanding the Challenges of a Liberalised Aftermarket

By Hanns Guenther Bollig

Background:

In June 2002 the European Networking Group organised a pan European Automotive Forum on the Automotive Aftermarket in Berlin. The event was titled “Strategies for an evolving After Sales marketplace for Vehicle Manufacturers, Suppliers, Dealers and Independent Repairers”. On this Forum, Automotive Advisors & Associates conducted a Workshop called “Understanding the Challenges of a liberalised Aftermarket”. Participating were 16 representatives of vehicle manufacturers, 15 representatives of leading suppliers, 10 dealers and 9 consultants. This paper summarises the results of this workshop.

Introduction:

Over the last ten years, the global automotive industry has been seriously underperforming in terms of financial results and shareholder value creation. This has happened despite the fact, that the automotive industry has been in the forefront of cost reduction, global consolidation and lean manufacturing. In this cash hungry world, where funds are needed for global expansion and new vehicle development, this is a serious problem.

Based on this experience, the industry has recognised that the deadlock cannot be broken by selling cars alone. Additional sources of income will have to be tapped; electronics and in-car entertainment, telemetric services, insurance policies, car rentals, lifestyle products, events. Practically everything that can be sold to an automotive customer is coming into focus. The contact to more than 250 Million customers globally is turning into the most valuable asset of the industry.

Unfortunately for the vehicle manufacturers, the dealers onw this contact. The fall of the block exemption in Europe will start a fierce battle to win or retain this ownership. The Internet will heat up competition even further. OEMs will attempt to gain ownership by providing product information, arranging test drives, managing the sales of used cars and arranging repair and emergency services for drivers on the road. But communication will not be a one-way street. OEMs will contact their customers regularly in order to obtain valuable feedback. They will conduct surveys, customer clinics, market research and they will try to receive other feedback that helps them maintaining contact and improving their overall product offering to the customers. Dealers may continue in their role by providing local showrooms, stocking points and repair facilities. Will this be enough for them?

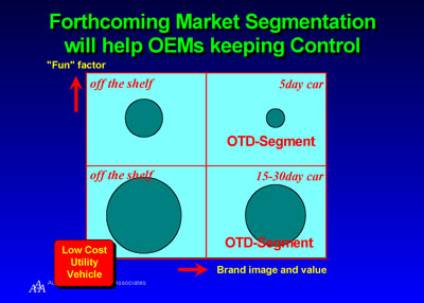

Forthcoming market segmentation will help OEMs control the markets. Order to delivery is a key concept for achieving this goal. Five day delivery to customer order for low volume niche cars and 15 day delivery to customer order for high volume, high image cars will put OEMs further in the lead. Will distribution of these vehicle segments turn completely into an OEM domain? Will dealers solely function as their remote show room, stocking point and service arm?

However, the other market segment of “off the shelf” cars, pushed into the market in high numbers, may become the dealers’ domain. Here, regional strength, location near the shopping centres and regular and high customer traffic may become the key to success. Closeness to shopping malls and colocation to major traffic generators may become a must. Impulse buying, price promotions, one-off models and spot sales could become the norm for selling these cars. The concept of “buy here, service elsewhere” could become standard. Will car dealers lose this business? Will retail chains take the lead? Will OEMs team up directly with them? Will the traditional dealer of the “cheaper” brands loose out? If additional sources of income are being tapped by the OEMs, will this also become a necessity for dealers? Can they afford to waste the time customers spend at their premises by offering them coffee, reading material or leisure activities to bridge any waiting time? Or should they seek to give them any opportunity to purchase whatever they may need, from newspapers to foodstuff, from presents to kitchen hardware, from daily supplies to one-off promotional materials? Do we remember when petrol stations were only selling petrol? Do we remember when “Tschibo” was only selling coffee in Germany?

The fall of the block exception also gives the suppliers an opportunity to approach the final customer directly. Whilst the structure of the aftermarket may change from a linear, largely closed supply chain into an open network of supply points, suppliers gain the opportunity to service every service point and every customer directly with their parts. This will be the case for OEM approved suppliers of parts but may also apply to other “free” suppliers which produce reverse-engineered parts to the specification of the OEM.

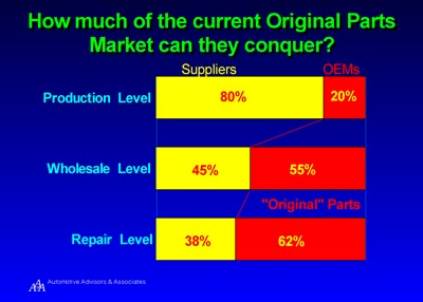

Today, OEMs produce 20% of all parts which are sold in the aftermarket. However, by controlling the supply channels, their range of control extends to 62% of the total market. Will this remain? The question is, how much of this market will be conquered by suppliers and how much will remain under the control of the OEMs. This likely depends on the way in which suppliers manage the markets.

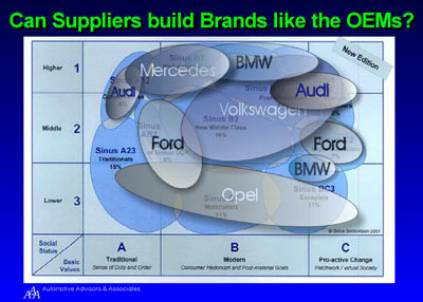

Can suppliers build brands like the OEMs? Or is channel management more important than branding? To what extent will price become more important than service? The automotive industry has become used to the fact that service is more important in the captive parts market than price. Will this change? Will price become the core element of competition? What will be the winning strategy? Who will be the winners? How must we respond?

The workshop teams were given seven questions for discussion.

1. Which strategies will OEMs adopt and how should dealers and suppliers react to them?

2. Will suppliers enter the market with their own “OE-parts” and what should be their strategies?

3. Will there be new chances for third party suppliers with reverse engineered parts? What should be their strategies?

4. Will there be new forms of distribution channels? Which will they be? What are their chances?

5. Is branding an issue for suppliers and dealers? How should this be done?

6. Will there be different forms of channel management? What will be the channel strategies?

7. Will there be a stronger focus on price or on service? What has to be changed?

8. The response of the workshop teams:

Question 1.

Which strategies will OEMs adopt and how should dealers and suppliers react to them?

OEMs are absolutely determined to protect their market share. They will try to achieve this by protecting their existing networks, setting the highest service and quality standards, extending warranties to customers and offering comprehensive service contracts to customers and conducting extra training and seminars for their dealers and staff in the aftermarket. Specialist offers could be made for owners of older cars and second hand car buyers.

Question 2. and 3.

Will suppliers enter the market with their own “OE-parts” and what should be their strategies? Will there be new chances for third party suppliers with reverse engineered parts?

Yes, suppliers will enter the aftermarket directly, without OEM consent. OEMs will try to set up barriers and participate in the aftermarket profits of their suppliers. They will calculate the likely aftermarket profits of the parts and deduce a part of the expected profits from the purchase price of the OEM supplies.

Despite of these impediments, suppliers are likely to be successful in gaining a greater direct market share for aftermarket parts. However, success depends on their ability to cope with the problems, building and maintaining excellent supply chains and developing their own successful marketing and sales strategies. Many of the participating suppliers who have good names in the industry were already in the start-up phase of building public awareness with the final customers and starting specialist aftermarket services for whole systems. They will not only serve their own products and systems but competitors’ products as well. It was estimated that more than 50% of the suppliers’ aftermarket revenue would come from re-engineered replacement parts.

It was reported, that the current fault diagnosis tools were performing well in terms of locating which parts or systems failed, but poor in detecting the nature of the problem. Better fault diagnosis and improved problem solving could be the particular advantage of the systems suppliers over OEMs.

Question 4.

Will there be new forms of distribution channels? Which will they be? What are their chances?

Future distribution channels will be more differentiated and focused on particular preferences of the customers. There will be brand or type focused distribution channels, price focused channels, internet focused channels and channels focusing on providing mobility solutions. Whilst supermarket chains are likely to establish cost focused distribution channels, finance companies will enter the market by offering total mobility packages, independent of brand, type or nature of the vehicle. Also traditional channels will become more diverse. There will be higher levels of specialisation and dealers and repair shops will farm out specialists services to other specialists. We are likely to see the development of specialists’ service networks which co-operate with each other.

Questions 5. and 6.

Is branding an issue for suppliers and dealers? How should this be done? Will there be different forms of channel management? What will be the channel strategies?

Branding will be a major issue for suppliers and dealers alike. There will be low-cost brands, systems specialists and mobility specialists. Each of them will build particular brand images focused on particular customer types, their needs and their buying preferences. Piggybagging could take place if targeted customer groups would overlap with the particular OEM brands.

There will be extremely diverse distribution channels. Channel management will therefore become an important issue. We will see similar approaches to channel management as in the other retail industries.

Question 7.

Will there be a stronger focus on price or on service? What has to be changed?

Service quality will remain the dominant factor in the OEM-controlled automotive aftermarket. Quality leaders will be the brand centres, authorised dealers and supplier franchises. Independent repair shops will continue to focus on price conscious customers. Supplier franchises will add low price and solution competence to their overall market offerings, however, focusing on a limited scope of products and services.

If you want to know more, please contact us: Automotive Advisors & Associates